direct vs indirect cash flow format

The indirect method of analyzing cash flow allows you to find the net cash flow and establish the relationship between the profit received and changes in the cash balance. This video compares and contrasts the direct method for preparing the Statement of Cash Flows to the indirect method for preparing the Statement of Cash Flow.

Cash Flow Statement Template In Excel Wise

In both methods there.

. Unlike the direct approach the net profit or loss from the Income Statement is adjusted for the effect of non. Financial statements provide crucial information about a companys finances to its stakeholders. The direct method is perhaps the simplest to understand though it is often more complex to calculate in practice.

Most users prefer the balance sheet and income statement. When the indirect method of presenting a corporations cash flows from operating activities is used this section of SCF will begin with a corporations net income. However the indirect method is much easier for a finance team to assemble since it.

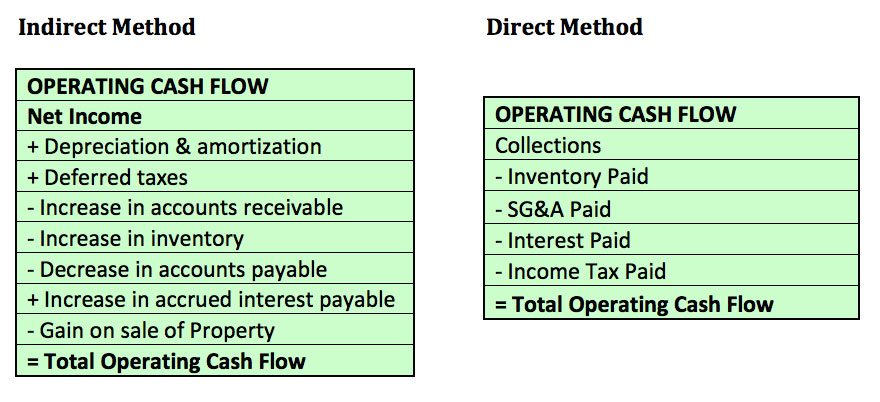

The Indirect method focuses on net income and non-cash adjustments. The net income is then. Direct vs Indirect Method of Cash Flow.

August 30 2021 Khayyam Javaid ACA. Indirect cash flow method adjusts net income for. The direct method is particularly useful for smaller business that dont have.

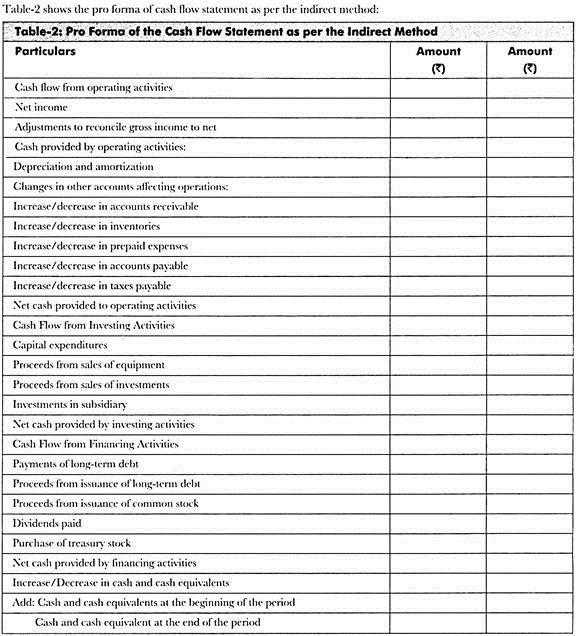

The cash flow from operating activities is the only section of the statement of cash flows that will change in presentation under the direct and indirect methods. It is a simple way of calculating your cash flow and can be done quickly from data readily available in your. The company s cash movement in one period is very important to report in.

A business cash flow statement shows the companys profits and losses within a given time frame. Direct or indirect method of cash flow. A cash flow statement is a summary of your companys incoming and outgoing cash from three main areas.

Cash flow statement can be prepared and presented by two methods namely direct method and indirect method. The differences between direct and indirect cash flow reports. 1 operations 2 investments and 3 financing.

Direct cash flow method lists all of the major operating cash receipts and payments for the accounting year by source. The direct method and indirect method of preparation of cash flow statement differ in the way the cash flows from operating activities is calculated and presented. The indirect cash flow method uses the same general classifications as the direct cash flow method.

The indirect method is widely used by many businesses. Examples of Cash Flow Statements Direct and Indirect Methods.

Direct Vs Indirect Cash Flow Methods Top 7 Differences Infographics

Example Direct Method Of Cash Flow Statement Financiopedia

/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

Cash Flow Statement What It Is And Examples

The Essential Guide To Direct And Indirect Cash Flow In 2022 Cash Flow Statement Cash Flow Positive Cash Flow

Solved Compare And Contrast The Two Methods Of Preparing The Cash Flow Statement Review A Recent Set Of Financial Statements On The Company Of You Course Hero

How To Make Sense Of Your Cash Statement Metamark Learning

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Indirect Cash Flow Method How To Use It And Why It Matters Bplans

Cash Flow Statement Meaning Preparation Limitations Of Cash Flow Statement

Cash Flow From Operating Activities Direct And Indirect Method Efm

Direct Vs Indirect Cash Flow Method Which Is Better

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

2022 Cfa Level I Exam Cfa Study Preparation

Example Indirect Method Of Cash Flow Statement Financiopedia

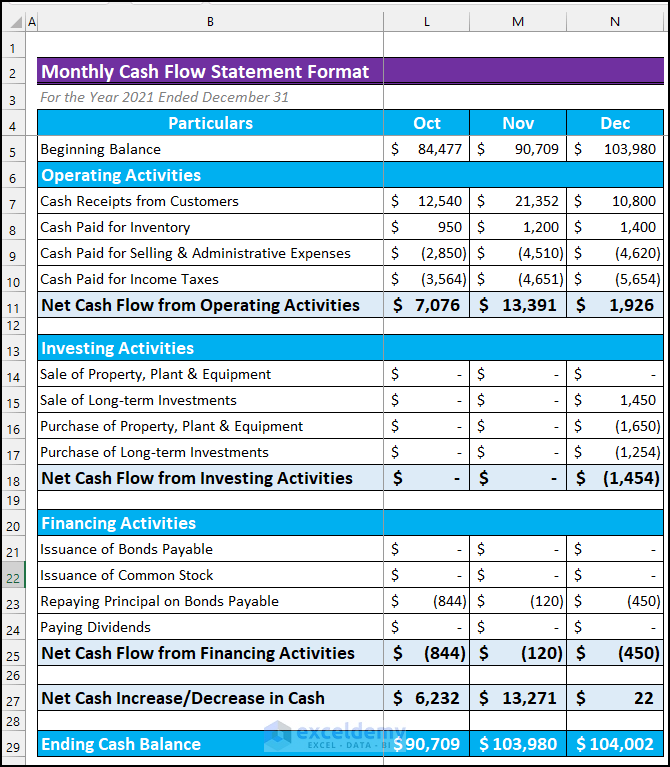

How To Create Monthly Cash Flow Statement Format In Excel

Solved Prepare The Statement Of Cash Flow In Indirect And Chegg Com

What S The Difference Between Direct And Indirect Cash Flow Methods 365 Financial Analyst

Cash Flow Statement Explanation And Example Bench Accounting